SIG Finances

- The Budget Process

- Background on SIG Finances

- Monthly Financial Reports

- Timetable for SIG Budget Preparation

- How To: Understanding the FMRs

A. The Budget Process

ACM and its subunits use a fiscal year that begins July 1 and ends June 30 of the following year. For example, FY '08 begins on July 1, 2007, and ends on June 30, 2008. SIG operational budgets follow this same timeline. SIG conference finances are entered into the SIG accounts once the conference is closed (within four months of the end of the conference, generally). The conference fiscal year is March 1 to the following February 28. Therefore, FY '07 included all sponsored conferences happening between March 1, 2006, and February 28, 2007.

The annual budget process for each SIG begins with the identification of Member Benefits in November for the following Fiscal Year. Member benefits are decided by SIG leadership. (More detail on Member Benefits can be found in Section 3.)

A number of key SIG volunteers need to have input in the SIG budgeting process. This varies from SIG to SIG, depending on specific goals for the next few years. Certainly expectations for SIG publications, for any membership drives, for special programs or projects coming up, for increases in budget lines, need to flow into the budgeting process. Generally, changes in SIG programs need to be sent to Finance by January 31 in order to be entered into the following year's budget.

SIG budgets have two components, organizational and conferences. The organizational portion of the fiscal year's budget includes the SIG revenue and expense lines without the sponsored/co-sponsored conferences. The overall SIG budget includes combined income and expenses from both SIG organizational and conference streams.

B. Background on SIG Finances

SIG Revenue Sources. SIGs have four streams of revenue:

- Membership and subscription fees

- Conferences

- Publications, including the ACM Digital Library

- Miscellaneous sources (interest, grants, corporate donations, etc.)

Membership fees (and Member Plus fees) are an obvious source of income for the SIG. Because the accrual method of accounting is used at ACM, as it is in most associations, only one twelfth of the membership income is shown in the monthly reports.

The net surplus (or loss) from conferences (after overhead) is divided proportionally among the sponsoring SIGs. The overhead is also divided proportionately among the sponsoring SIGs.

Income to SIGs from sales of proceedings and copies of newsletters has been declining in recent years as more and more individuals and institutions use the ACM Digital Library for research.

ACM Digital Library revenue is distributed to SIGs in proportion to the downloads of their materials from the ACM Digital Library. In addition, the SIG Governing Board has the option to designate income from the Digital Library for special uses.

SIGs receive interest on the amount in their fund balance. Some SIGs receive corporate support at the SIG level, although it is much more common for a corporate donation to be received in support of a conference. A few SIGs occasionally receive grants in support of projects. All these are included under the rubric of miscellaneous income.

SIG Expense Lines. Similarly, SIGs have a number of expense lines. The largest SIG operational expenses generally are:

- Production and distribution of newsletters, proceedings, CDs/DVDs, etc.

- Travel grant programs for students and educators

- Special Projects, such as support for regional conferences or summer programs, small research projects providing useful data to the community as a whole, etc.

- Travel and meeting expenses for SIG Executive Committee meetings, SGB meetings, and to other meetings to represent the SIG.

- Web site maintenance and design.

The general practice at ACM is that the SIG Treasurer or SIG Chair approves expense items by email.

Overhead. This fee is part of doing business at ACM. It is not a fee for service. It is currently calculated based on the total expenses of each SIG, both general operations and conferences.

Updated overhead policy per approval of the SGB 3/10/23

1. Overhead rate policy should be maintained, as voted and approved last year by the SGB.

a. The SGB EC should work with SIGs that are struggling to pay their overhead expenses and continue conversations.

b. The SGB should be provided an annual report on the performance of the current overhead policy, including

i. The ability of the 38 SIGs to reimburse ACM for total SIG related annual expenses, and

ii. Our progress towards replenishing the Overhead Reserve Fund on an annual basis.

c. The SGB should conduct a formal review of the overhead rate calculation every 3 years (next review in FY ’25).

2. Institute additional communication channels between ACM headquarters and the SIGs

a. SGB EC should work with ACM to provide formalized information channels to SIG leaders, members, and communities on what services ACM provides and the role of overhead in the operation of SIGs and ACM.

b. The SGB EC should develop formalized mechanisms for SIGs and ACM to discuss changes in services.

Updated Overhead policy per approval of the SGB 5/13/22:

MINIMUM OVERHEAD FEE: A minimum $25K overhead will be assessed to each SIG annually.

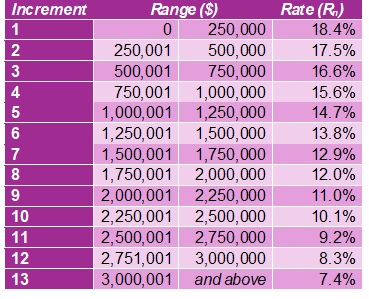

OVERHEAD CALCULATION METHOD: Each SIG will be assessed an overhead fee, based on its total expenses (governance- plus conference-related) using a rate scale based on increments of $250K in expenses:

- SIGs with <=$135K in total expenses pay the minimum fee of $25K

- SIGs with expenses >$135K and <=$3M pay based on increments of $250K.

- Expenses for each increment range are assessed at applicable increment rate up to the total amount of expenses.

- For example, the first $250K is assessed at a 18.4% rate, the following $250K is assessed at a 17.5% rate, and so on.

- For SIGs with expenses >$3M, the rate flattens at 7.4% on any amount over $3M

OVERHEAD RESERVE FUND: The SIG Overhead Reserve Fund (SORF) is used to "smooth" the year-to-year variation in the amount of overhead recovered based on SIG expenses.

- If the Overhead amount recovered across all SIGs in a given year based on the Overhead Calculation Method exceeds ACM's SIG-related costs for that year, the excess will be added to the SORF. If the SORF grows larger than half the maximum annual SIG-related costs over the prior 5 years, the SGB will determine the next steps regarding the amount in excess of the required SORF balance.

- If the Overhead amount recovered across all SIGs in a given year based on the Overhead Calculation Method falls short of AMC’s SIG-related costs for that year, the SORF will be used to cover the shortfall. At no time, the SORF cannot fall below zero. If necessary, the SGB-EC will choose whether to cover the shortfall from its own reserves or charge the SIGs additional overhead to make up the difference.

From the April 29, 2022 minutes:

The SIGs are doing well financially but the OH calculation method isn’t covering SIG related costs. That means that other ACM groups have had to subsidize the SIG operations. The ACM President charged the SGB to update the calculation for FY’23. This was the final step in a multi-year effort to improve the processes so that finances are clearer for volunteers. The TF was charged with reviewing how SIG OH is handled and to make recommendations for adjusting the process. The timeline began in January/February with recommendations being presented to the SGB for questions and discussion today. The expectation is that the SGB will vote on a new method in early May and in early June, the ACM

Prior to FY'23

To cover overhead, SIG leaders (through action of the SGB) have chosen to implement a formula based on a sliding scale, starting at 16% in FY'07 and FY '08, and decreasing by 0.8% for every $125K of expenses. Thus different SIGs and their conferences vary in the percentage used for overhead. The activities covered under overhead include general office support for SIGs and their conferences, accounting and finance support, and assistance with publications, membership, marketing, webpage/wikis, etc.

For background and detail of discussions of the topics of overhead, see Minutes of the SGB,

- October 14, 2000

and additional discussion at the SGB meetings of - August 19, 2001

- February 23, 2002

- March 16, 2003

- September 20-21, 2003

- January 27, 2004

- March 21, 2004

Variations from Budgeted Amounts. Small variations from budget in individual line items are normal and expected. Any net variation in a SIG budget by 5% or more is referred to the SIG Governing Board Executive Committee for review and approval.

Fund Balance. The SIG Fund Balance reflects the net worth of the SIG. It is the cumulative net of all the SIG's revenues and expenses. The Fund Balance provides reserve funding for the SIG.

ACM policy requires all ACM subunits to maintain adequate reserves against unexpected occurrences. This is referred to as the Required Fund balance. The Required Fund Balance is calculated using this formula: 50% of organizational expenses + 50% of conference expenses. The Required Fund Balance is established for each SIG as part of the annual budgeting process.

Surplus funds from conferences and SIG activities are added to the SIG Fund balance at the end of the fiscal year.

Conference Budgets. ACM conferences are budgeted conservatively, often to merely break even or to have a small surplus. By budgeting conservatively, the hope is that conferences will do well, while minimizing potential risk on the downside. Figures used for conferences during the budget process are drawn from approved budgets, prior year conference final figures, or prior year conference budgets. The number of conferences that a SIG sponsors and the percentage of sponsorship all are reflected in the SIG budget.

C. Monthly Financial Reports

Monthly Financial Management Reports (FMRs) are posted online, with access given generally to the SIG Chair and SIG Treasurer. (Conference reports are generally available to the Conference Chair and Conference Treasurer.) New reports are posted approximately the third week of the month for income and expenses from the prior month. Contact your SIG Services Program Liaison if you have questions about access.

Organizational Income and Expenses. The notation "organizational" in relation to SIG budgets indicates revenue and expense lines that are general expenditures of the SIG; conference income and expenses are initially reported by conference. Information on the SIG's organization budget is available separately in both the budget and the FMRs.

The basic income and expense figures on the organizational lines show greater expenses than income for some SIGs. SIGs with a number of generally prosperous conferences and a healthy fund balance sometimes opt to use conference surpluses as a way to keep member dues at or below actual cost.

Conference Income and Expenses. Income from all conferences sponsored (or co-sponsored) by the SIG are aggregated on one income line for the SIG budget. (For co-sponsored events, the income and expenses are divided proportionately among the sponsors.) These figures are not entered into the FMRs until the conference is closed, normally 120 days afterward the conference concludes. The fiscal year for conferences is March 1 through the following February 28. Conference expenses are aggregated in the same fashion.

Overhead. All SIG expenses, both organizational and conferences, are assessed an overhead fee to cover the basic costs of doing business. While the exact amount of the SIG overhead is calculated at the end of the fiscal year, the amount budgeted is based on the organizational and conference expenses included as part of the budget.

Keep in mind that the SIG is responsible for overhead for all expenses, both organizational and by its conferences. If, for example, a conference does poorly, the SIG absorbs any loss both absolutely and in terms of obligation for overhead due. SIGs can reduce or eliminate overhead for their conferences but must then pay the conference overhead from the organizational side.

Using the FMRs. The FMRs can provide valuable information about the workings of the SIG. Looking at the year to date figures, a comparison of the amount in the Actual to the amount in the Budget shows where income or expenses stand in relation to expectations. Keep in mind, however, that expenditures for some budgeted items occur almost entirely within a month or two, while the budget line assumes roughly equivalent expenditures throughout the year. Two examples of this are awards and travel grants, which are often largely expended around the SIG flagship conference.

SIG leadership generally has more control over expenditures than over revenue lines. There is also the ability to adjust expenditures during the year in line with revised revenue projections. For example, if SIG conferences are doing better than anticipated, support for other SIG activities (like student travel grants) can be increased.

In recent years, many SIGs have seen shortfalls on the revenue side. Review actual income as compared to projected income year to date to determine whether your SIG is on course. Sometimes adjustments to the yearly expenditures are needed.

The SIG Treasurer is able to review expenses on a monthly basis through the FMRs, and should ask the SIG Services Liaison about unfamiliar expenditures. Problems and errors can be detected early on and dealt with quickly in this way.

- Track Revenue

- Examine Revenue

- Analyze SIG Organization and SIG Conference Expenses and Revenues

Reviewing the numbers for your organization and conference items separately allows a quick analysis of the relative strengths of each. Keep in mind that conferences are budgeted conservatively.

Some SIGs run a deficit on the organization side of their budgets. Past SIG leaders may have deliberately subsidized membership costs from conference surpluses. Present-day trends and recent conference results (net surplus or loss) should be examined to determine whether using conference revenue to subsidize membership makes fiscal sense.

Conferences are usually budgeted to break even, or make a small surplus. Larger attendance than budgeted or generous corporate support can lead to a better conference experience for participants and an overall conference surplus. - Calculate Costs Per Member

By comparing costs for membership benefits with the total revenue from SIG membership fees, SIG leaders can consider appropriate adjustments to fee levels. Your SIG Services Program Liaison or the Finance Department can assist in making this analysis.

The Fiscal Year is closed out during July and August. SIG Chairs and Treasurers are usually notified when final figures are available for the preceding year in the FMRs. Once the prior year is closed, financial information for the new fiscal year becomes available.

Each year some expenses are accrued from one fiscal year into the next. A membership benefit that is not completed and available to members within the fiscal year is a prime example of an item that is accrued under generally accepted accounting principles.

D. SIG Budget Timetable

Timetable for SIG Budget Preparation

| November | Membership Benefits due for next Fiscal Year |

| December | Notify the SIG Chairs and Treasurers of specific timeline for next FY budget. |

| January | Finance compiles and inputs appropriate data, based on membership benefits, prior year data and current trends in membership and subscriber statistics, conference information, current SIG expenses, etc. SIG Treasurers supply Finance with new information on existing SIG programs (Special Projects, awards, grants, etc.) and any new programs. |

| January 31 | SIG Treasurers submit any changes in member dues and subscriber rates for inclusion in the Publications Catalog as well as for use in the budget process. |

| February | Finance provides SIG Chair and Treasurer with preliminary draft of budget, for consideration by SIG leaders. (Finance staff available for consultation as needed.) |

| March | SIG budgets are approved by SIG leaders and returned to Finance. SIG budgets are reviewed and approved by the SIG Governing Board. |

| March 31 | The complete SIG budget is included in ACM budget draft to be presented to the ACM EC and Council. |

| May | Approval at the ACM EC/Council level |

E. How To: Understanding the FMR's

SIG and conference leaders have access to the Financial Management Reports (FMRs) online at http://fmr.acm.org. New FMRs are posted approximately the third week of the month, and contain information through the end of the prior month. The reports are drill-down; that is, by doubleclicking on underlined numbers, the details of the item are shown on a separate page. Categories are not displayed unless there is budget or financial activity for the line.

The FMRs show activity in the most recent month and the total year to date. Three columns are shown for each of these: actual, budgeted and variance from budget. The most useful of these columns is generally the Actual Year-to-Date. Comparing actual with budgeted is most useful for many of the income and expense lines. However, quite a few SIG expenses (in particular) occur in a single month - for example, awards expenses are usually found in conjunction with the flagship conference. Funding for travel grants usually is largest in the weeks following the flagship conference.

Revenue Lines. The revenue lines below are grouped by

- SIG Dues (619)

- SIG Non-Member Subs (623)

- Other Subscription Rev (629)

These are dues and other basic SIG revenue lines. These are allocated over the subsequent twelve month period, rather than posted in the month received. - Newsletter Sales (631)

- Proceeding Sales (632)

- Journal Sales (634)

- Electronic Pubs Sales (636)

- Other Single Copy Sales (639)

These items can be described as sales of single copies of proceedings, newsletters, SIG CD and DVD materials, etc. - Digital Library (628)

SIGs receive income from the ACM Digital Library every year, based on the number of downloads of SIG materials. - Conference Revenue (651)

As conferences are closed, usually 3 to 4 months after the conference takes place, the total conference revenue is added to this line. Conference expenses and overhead are on expense lines. - Interest Income Distribution (692)

The SIG fund balance is invested, along with other ACM and SIG funds. The income derived from those investments is estimated and then adjusted at the end of the year.

- Volunteer Travel (812)

This category includes travel by SIG officers and Executive Committee members for SIG business, as well as ACM staff travel to conferences and SIG meetings. Meeting room and other meeting expenses for SIG Executive Committee members may also be charged here, or to Meetings and Special Functions, 882). Travel support for official SIG representatives to other organizations, such as IFIP, is also included in this line item. (Note: All travel in this category must be approved by the SIG Chair or designee. Travel information is located at Travel Grant Guidelines.) - Communications (833)

- Mailing and Handling (834)

- Stationary/Supplies/Equipment (835)

Basically, these are office expenses charged to the SIG. Included on these lines are conference calls, election or other mailings to SIG members, etc. These expenses are minimal in this electronic age. - Production Expense (841)

- Distribution Expense (842)

These lines are used for newsletter expenses. Printing of newsletter or other SIG material falls under production. Postage and other routine charges (handling, sorting, etc.) are charged to the distribution lines. The manufacturing and mailing of other member benefits, such as CDs, are often charged here as well. - Other Pubs Services (847)

Some SIGs provide administrative or editorial support for their newsletter or other publications. Those and similar services will appear on this expense line. - Web Page Consult/Design (857)

Support for updating, upgrading or redesigning the SIG web pages are listed here. - Other Professional/Consultation Services (869)

Charges for professional services or consultants are charged to this line, if they are paid from SIG funding. - Grants (872)

This line pertains to travel grants, most often for students, to attend SIG conferences. There is additional information about travel grant programs under member benefits, specifically in Section 3.g. SIG Programs. Note that while sometimes travel grants are referred to informally as scholarships. - Awards (873)

Award checks, plaques, gifts, and travel subsidies for SIG awards are charged on this line. Some conferences have best paper and other awards, and any SIG funding for those is included in the conference budget. - Projects (875)

Both new and on-going projects are included in this category. Examples of SIG activities that fall under the projects category include: supporting focused summer programs, supporting speakers at regional conferences, providing an additional DVD to SIG members, contributions to specific programs in other organizations. - Meetings and Special Functions (882)

This category is used for hotel, meeting room, audiovisual and other incidental expense for meetings involving the SIG Executive Committee or other SIG committees.

- Conference Expense (891)

As conferences are closed, usually 3 to 4 months after the conference takes place, the total of conference expenses is added to this line. This is in parallel with the listing for conference revenue (651). - Overhead (900)

Each SIG is responsible for covering a portion of the general costs of ACM doing business. (See earlier in this section for additional information.) - SIG Board Overhead (903)

Costs of maintaining the overall SGB operation are apportioned over all SIGs. - Service Charge to Conferences (904)

In each conference budget there is overhead, an administrative fee, as one of the expense lines. As each conference is closed, the overhead is included as a conference expense, and then again on this line as an offset to the SIG's overhead assessment.

ACM/SIGs take a financial risk by promising to provide member benefits and by sponsoring conferences. Therefore, ACM policy requires all SIGs to maintain adequate reserves to cover unexpected losses. An amount is calculated for the Required Fund Balance, set by action of the SGB, at 50% of operational expenses and 50% of conference expenses. (See Minutes of the meeting of the SGB, March 21, 2004 for a detailed discussion of this requirement.)

Join an ACM SIG

Network with like-minded professionals and enjoy unique opportunities to share technical expertise and first-hand knowledge of the latest trends.

Virtual Conferences: A Guide to Best Practices

In March 2020 ACM formed a Presidential Task Force (PTF) to help conference organizers transition their events to online. The PTF is working on a guide to offer practical advice and shed light on the largely unfamiliar territory of online conferencing.

The report, available here, includes pointers to a live document with additional resources. We welcome comments, suggestions and experience reports from the community.